Why Inelastic Supply is not the Future of Cryptocurrencies

A stable currency is that which successfully performs its functions as a unit of account, a means of exchange and a store of value due to a stable purchasing power. Stability, however, does not connote a fixed nominal currency value as common in the intent and design of most of the current stablecoins. The Basis model’s attempt at stability, although, yet untested, suggests a characteristic of no reaction function which leaves it open to wide variations. Also, the incentive to participate in stabilizing the coins is capped once the bond buyers are paid off, and the remaining profit distributed to the shareholders that may or may not have played any part in the stabilization of the coin. This is an undue advantage designed to forever favor the shareholders and disincentivizes traders from actively supporting the stabilization process.

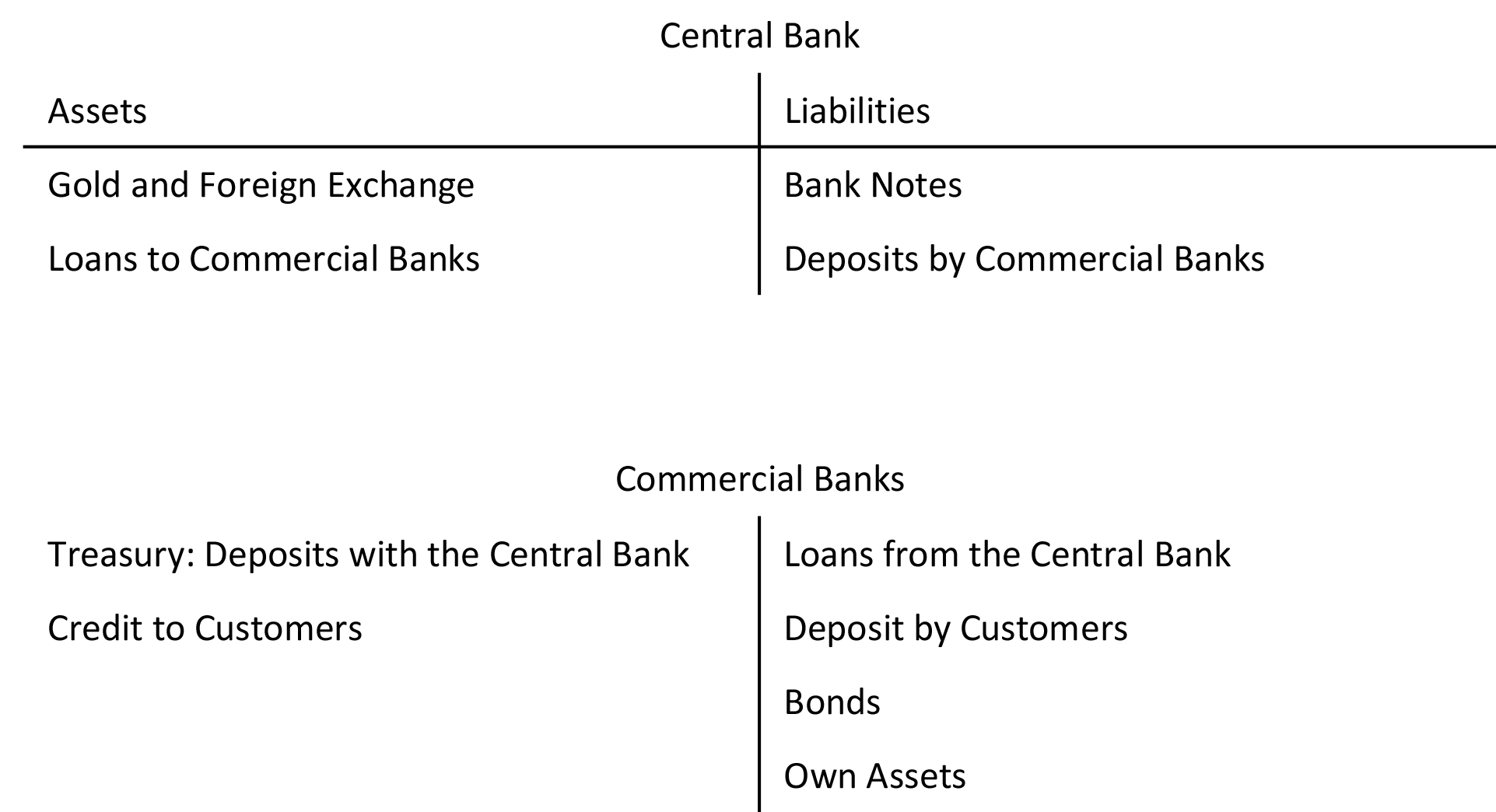

The collateralized coins, on the other hand, are one way traffic and digital representation of fiat currencies, that only increase coin supply and fail to take advantage of how the current central banks manage money growth through the key characteristic of elasticity. In reality, aside from the notes which are issued on demand, and form a very small proportion of money supply, the central bank does not control the money supply directly. In economies with developed financial systems, money supply fluctuates in response to the decisions taken by numerous stakeholders. The velocity of money and output also change according to the dictates of the prevailing economic conditions. The table below shows the link between money supply recorded under liabilities of the monetary authorities and the credit recorded under assets.

What the central bank controls as its main instrument of monetary policy is the interest rate it charges on very short-term loans to the commercial banks. When faced with a threat of price instability, the central bank will raise its interest rate. This directly influences the rates charged by the commercial banks. The general interest rate rise will reduce the expansion of credit, and invariably money supply. On the other hand, the central bank will lower its interest rate to stem deflationary pressure, which in ideal situations translates to expansion in credit and money supply.