How Monetary Policy Works

Monetary policy continues to evolve, and many of the advanced economies have now moved from the days of monetary growth targeting to inflation targeting. Price stability in developed economies is currently anchored around a price index of less than, but close to 2% over the medium term horizon as short-term general price fluctuations are oftentimes beyond the control of the central bank. The apex bank of many countries also assign a privileged role to the exchange rate, as it affects price stability, particularly in countries that are import dependent. It so happens that actions taken to maintain price stability also serve other purposes, such as maintaining financial and economic stability.

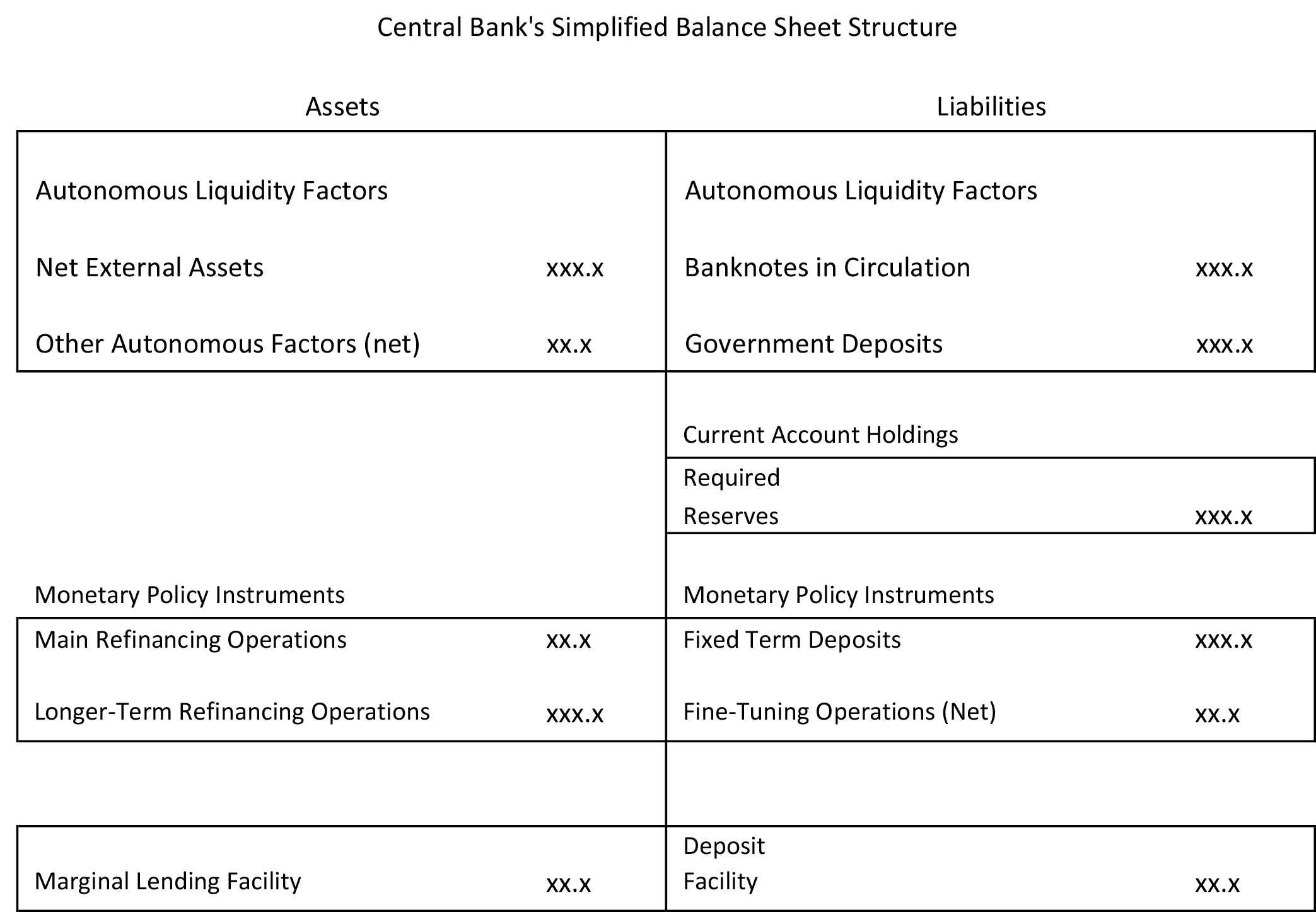

The first element of every central bank’s strategy is to define its primary objective. This allows the general public, businesses and stakeholders to set their expectations and judge the policy decisions of the monetary authorities. Due to the lagged effect in the transmission of the policy initiatives to the intended target levers of the central banks, monetary policy is now tending more towards proactive and forward-looking measures rather than reactive. Monetary policy involves adjusting the conditions under which the commercial banks can obtain liquidity from their central bank, thus influencing the interest rates on very-short-term credits.

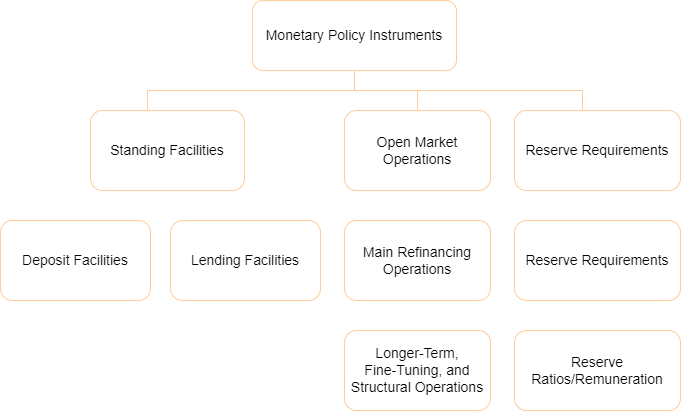

The central bank has a number of instruments and procedures with which it controls liquidity in the financial system. There’s the standing deposit, and lending facilities. These provide access to deposit funds with, or loan funds from the central bank at a specified rate on an ongoing, non-ad hoc basis. The idea of a standing lending facility is to enable banks to obtain funding from the central bank when all other options have been exhausted, while the standing deposit facility provides an option for banks to park their excess funds, for which there are no takers in the market, with the central bank. The market logically operates within the standing deposit and lending interest rate corridor, as a bank having excess cash would demand the minimum rate from a borrower of funds, which it can get from the Central Bank by depositing its excess cash. The maximum rate it can charge would be below the standing facility rate at which the central bank gives liquidity to the participants at a penal rate.

Central banks conduct open market operations by which they grant credit to commercial banks periodically. As a counterpart, the commercial banks have to deposit guarantees with the central bank, indicate the amount of credit they wish to obtain, and the interest rate they are willing to pay. The central bank gives priority to the banks that have offered higher interest rates. Central banks also trade securities with its member banks. When the central bank wants to raise interest rates, it sells securities to banks, mopping up liquidity. When it wants to lower rates, it buys and injects liquidity into the system. The open market operations is also the lever by which central banks conduct longer term financing, fine-tuning, and structural operations.

Central banks also control liquidity in the system through the use of reserve ratios. Cash reserve ratio is the amount of cash that commercial banks need to keep as reserve in the current account maintained with the central bank. An increase in the cash reserve requirement effectively lowers the amount of money available for lending purposes by the commercial banks. A reduction in this ratio by the central bank signals an expansionary intent, increasing the money available to the commercial banks to lend. The liquidity reserve requirement is the ratio of net demand and time liabilities that banks are required to keep in the form of liquid assets before it starts providing credit to its customers. This ratio can be deployed to increase or lower credit expansion, and also serves to ensure solvency of banks.